With Easy-To-Modify Designs, Check Out Template.net's Free Tax Invoices Excel Templates. We Guarantee Simple and Downloadable Service Tax, Medical, Contractor, and Customer Invoices for Tax Payables. All Prewritten Details Are Editable in Word and Excel Format to Make the Task Hassle-Free. Waste No Time and Grab a Printable Document Today!

Get Access to All Microsoft Excel Templates Instant Download

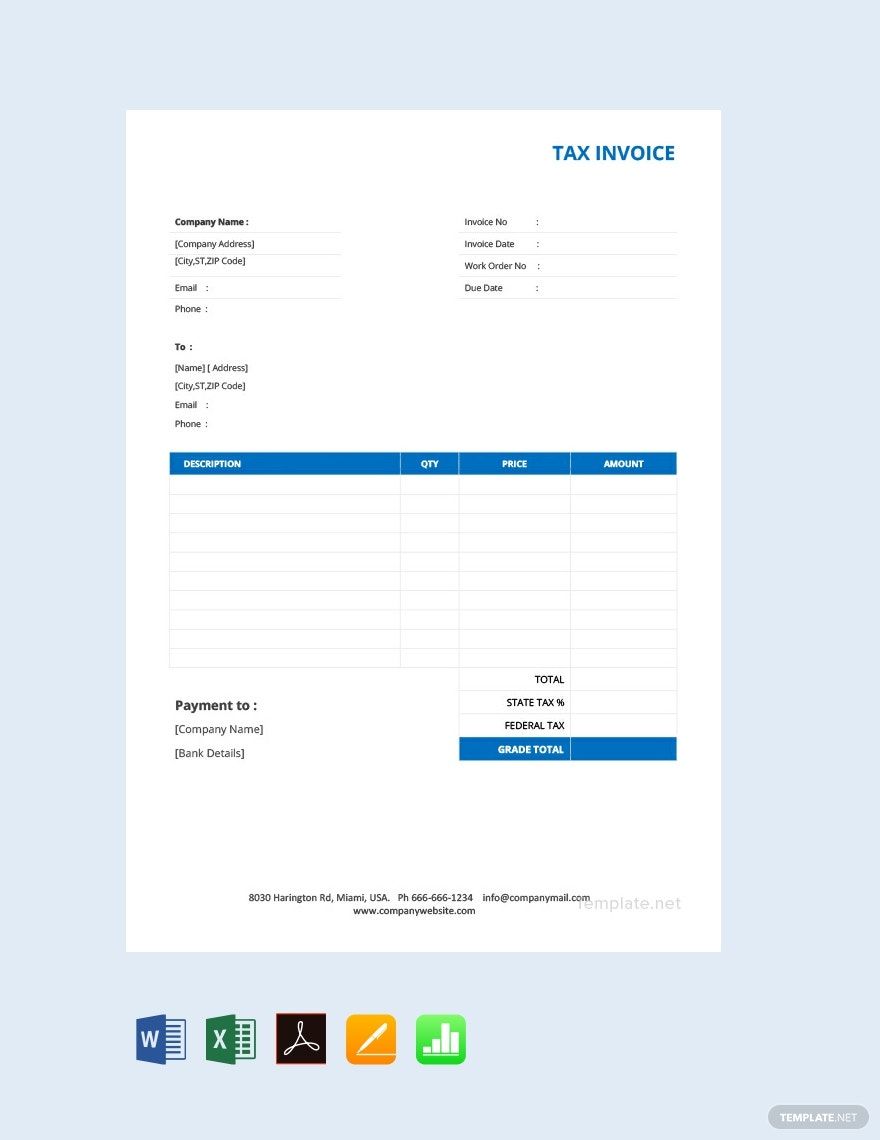

Basic Tax Invoice Template

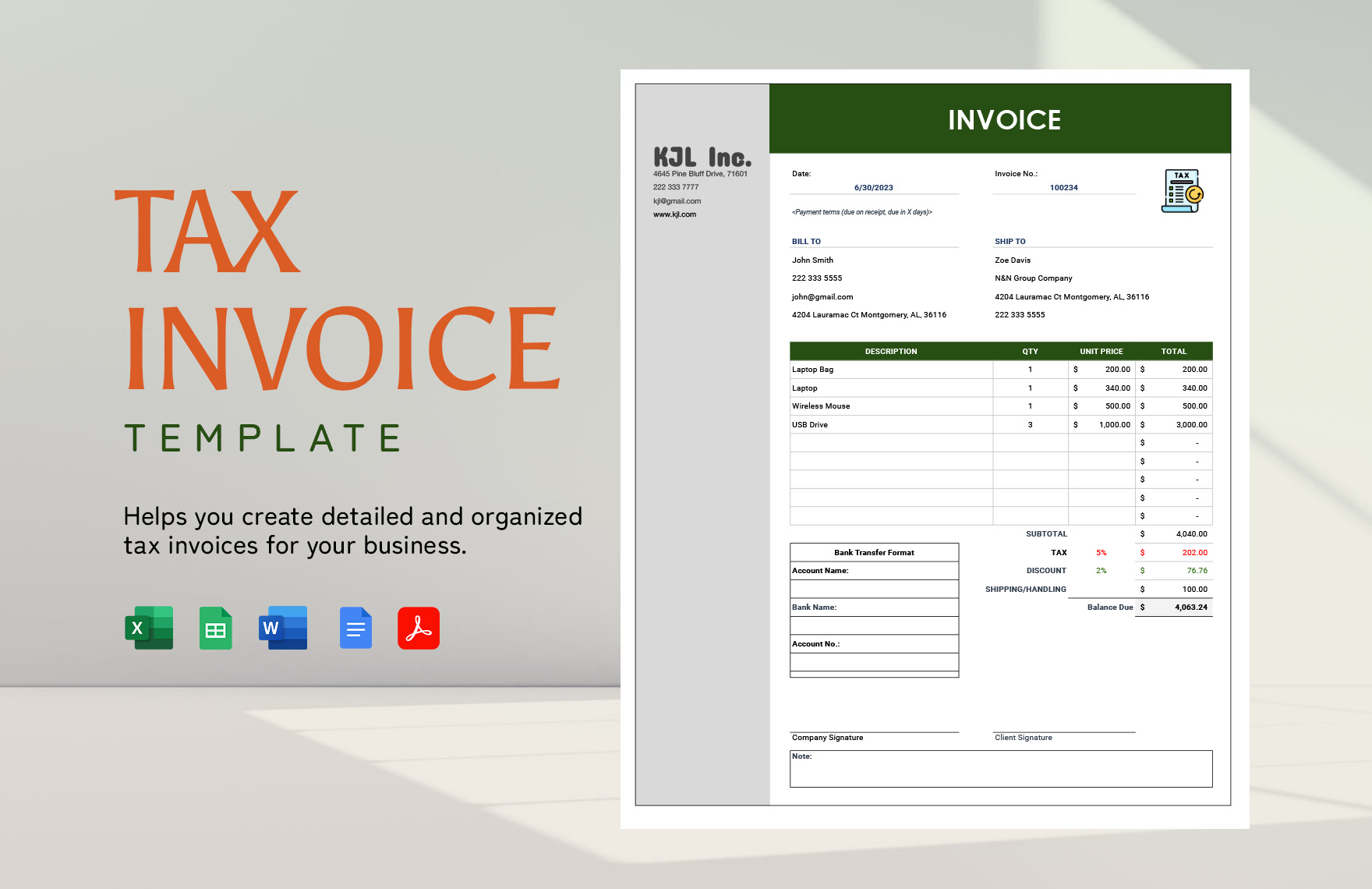

Tax Invoice Template

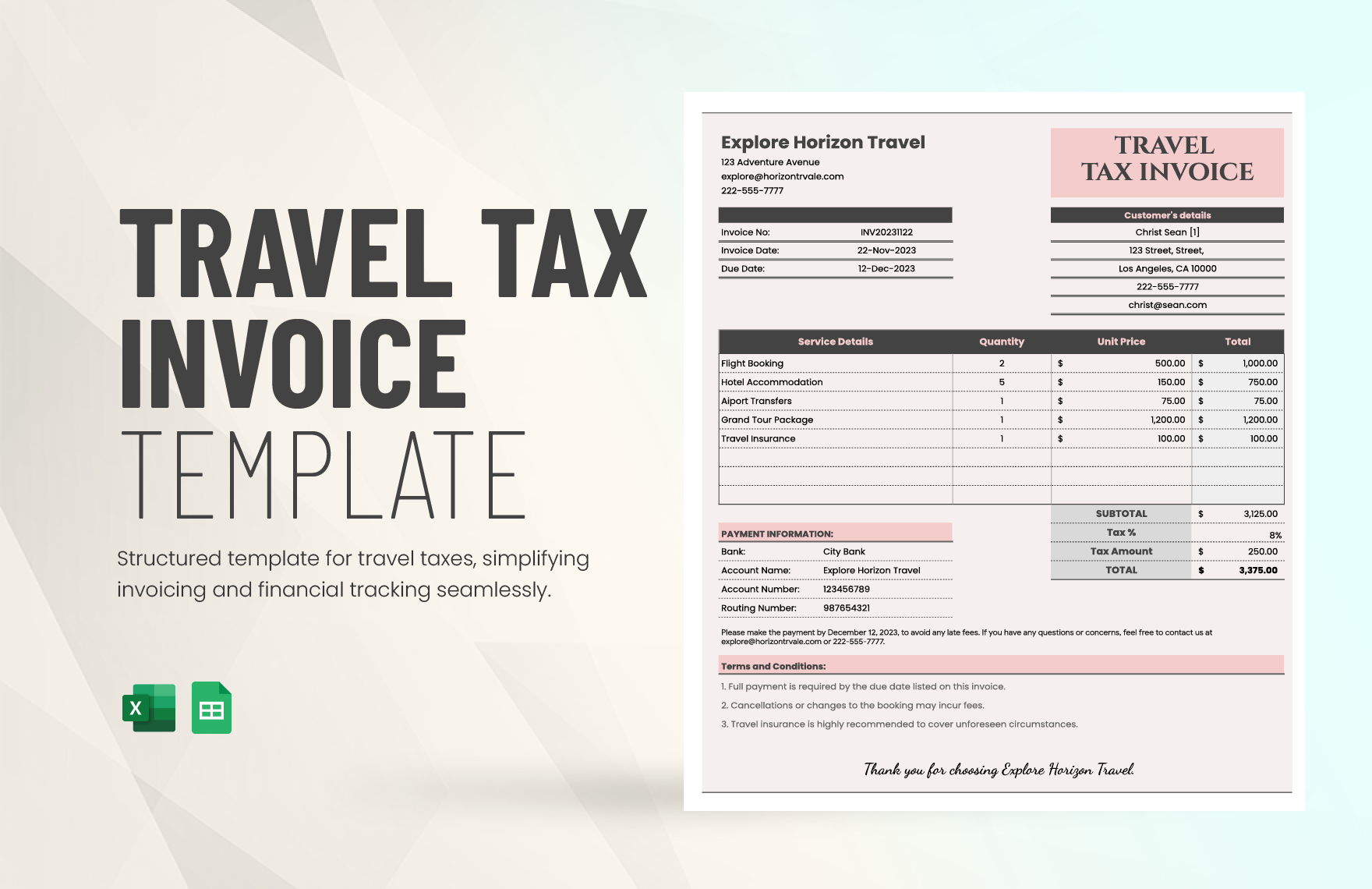

Travel Tax Invoice Template

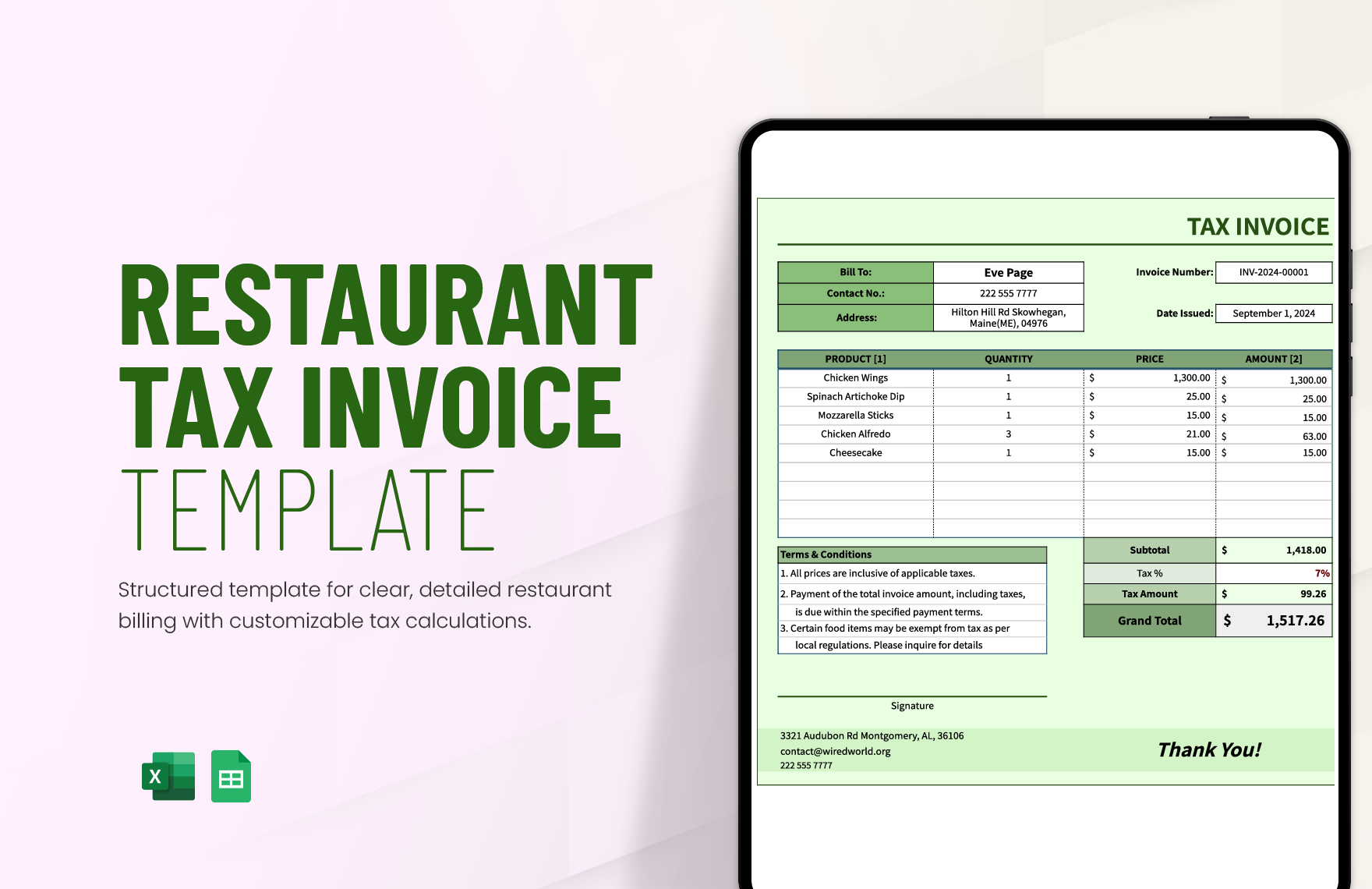

Restaurant Tax Invoice Template

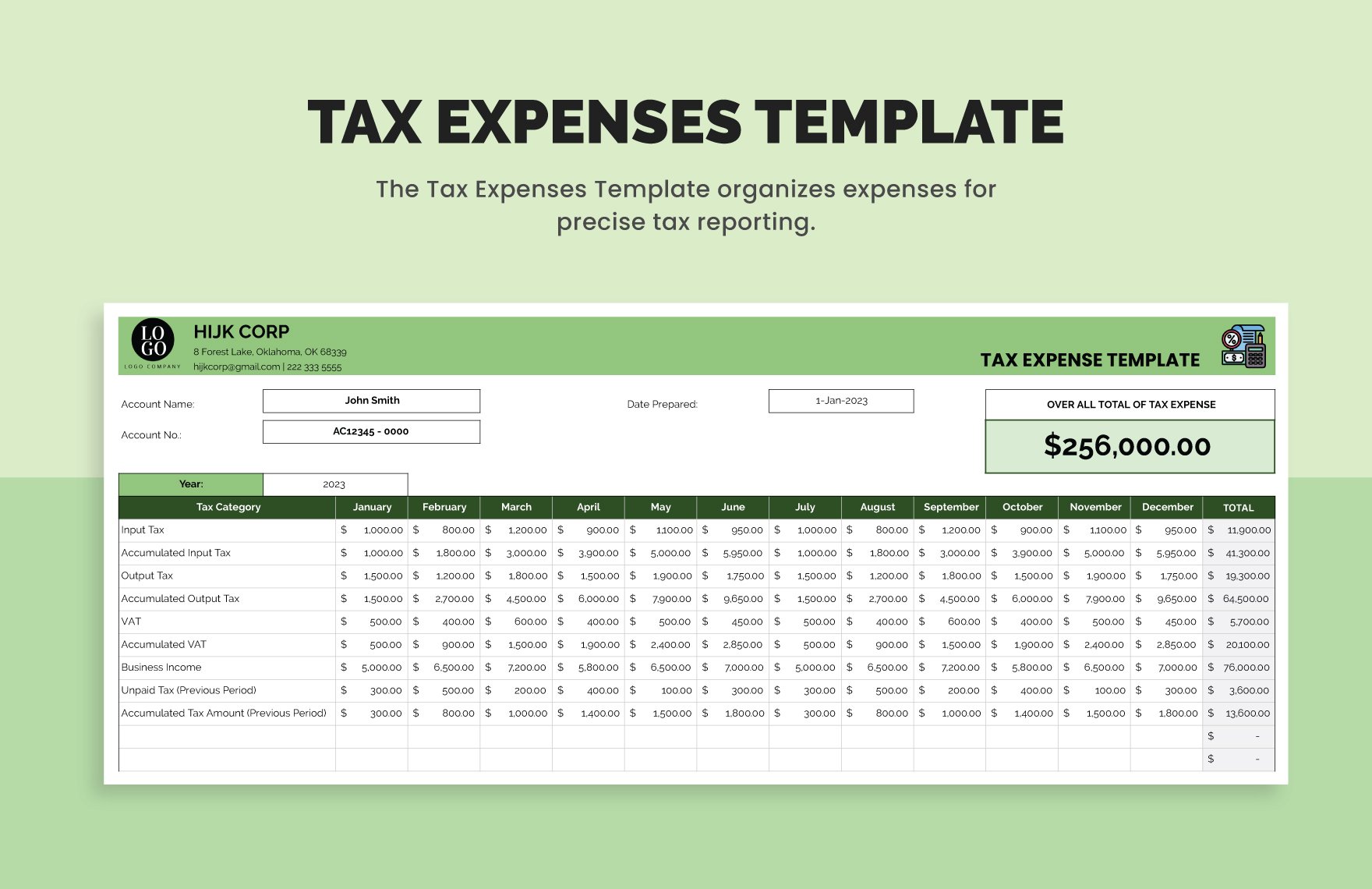

Tax Expenses Template

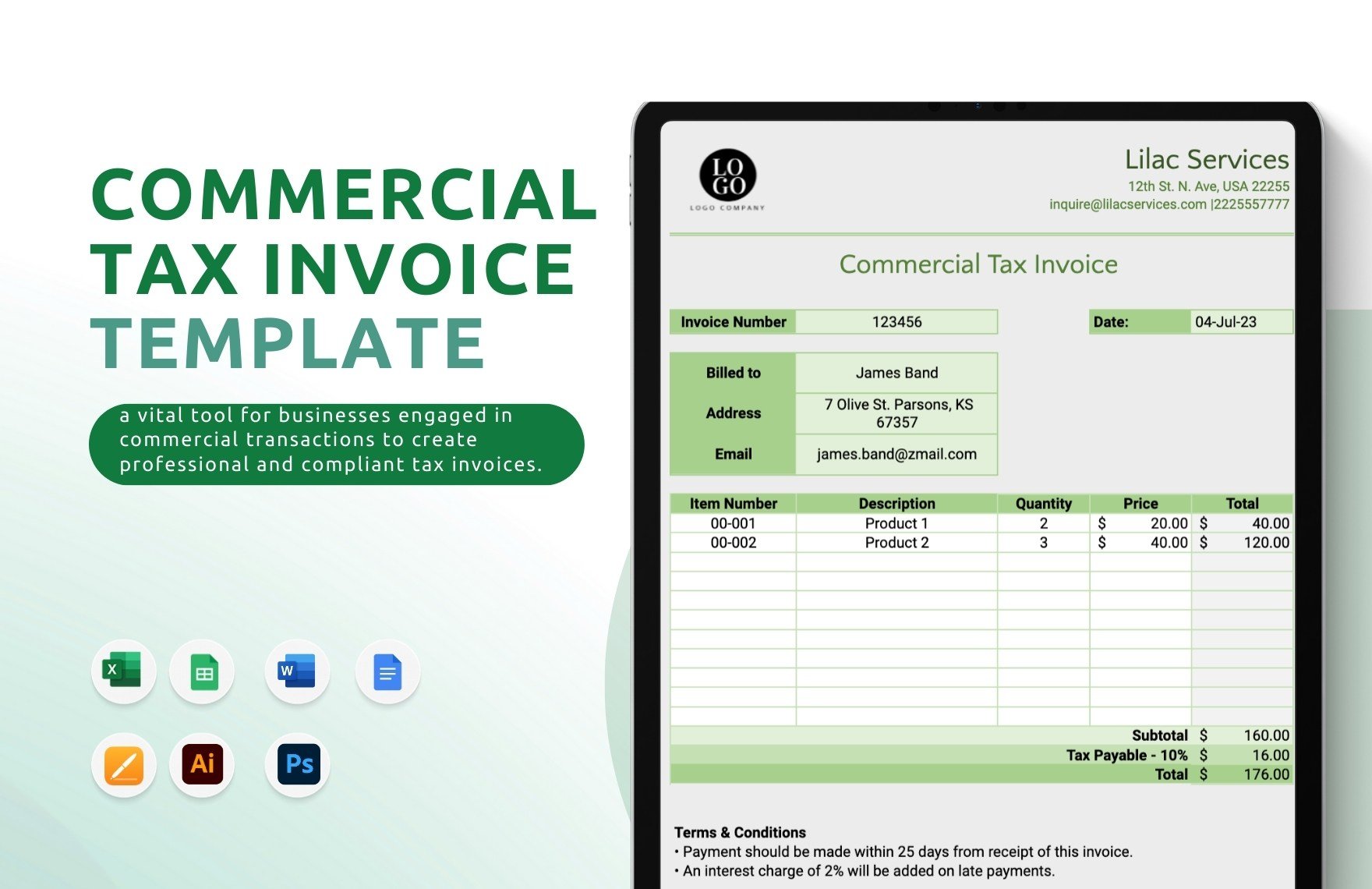

Commercial Tax Invoice Template

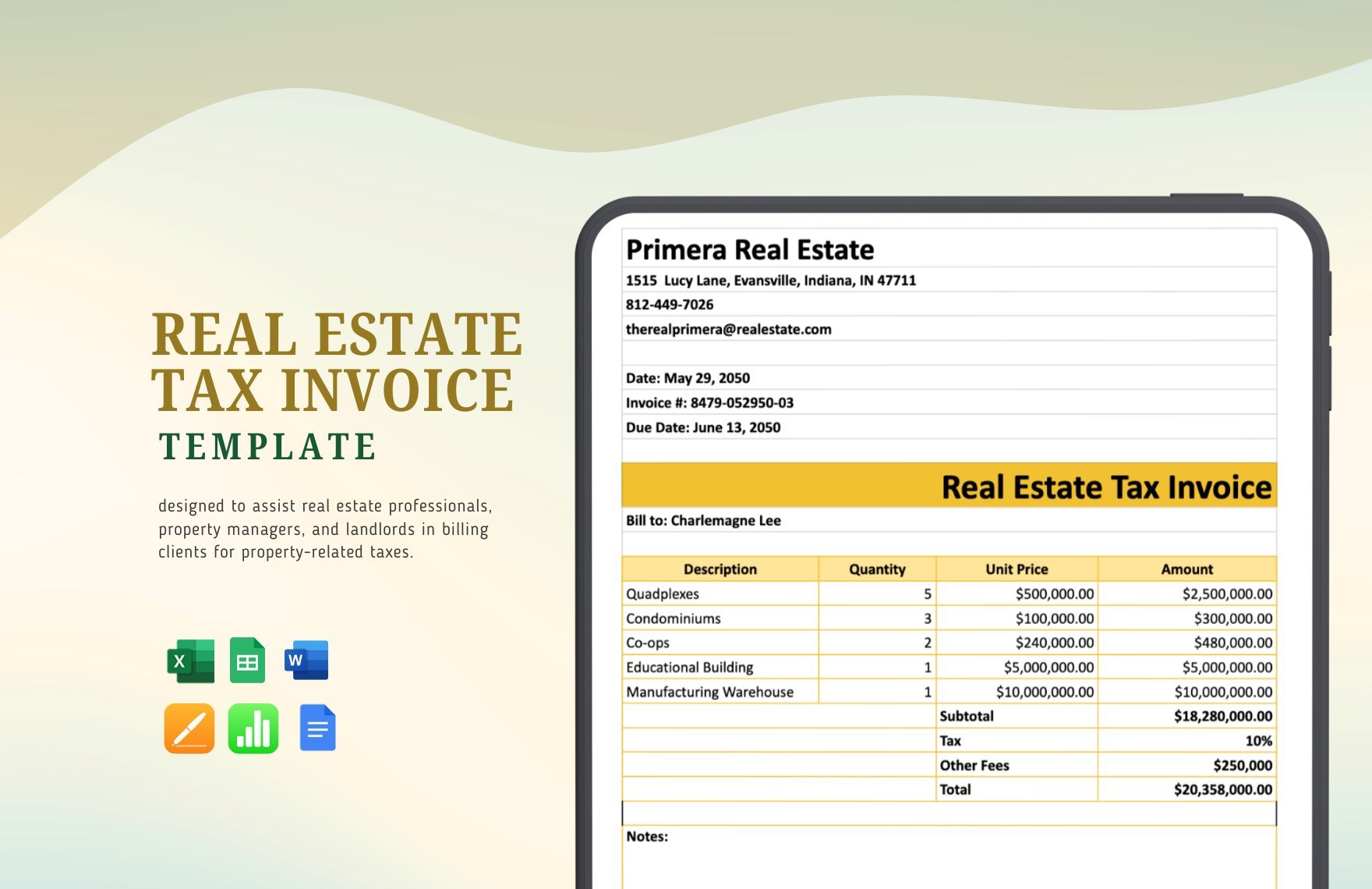

Real Estate Tax Invoice Template

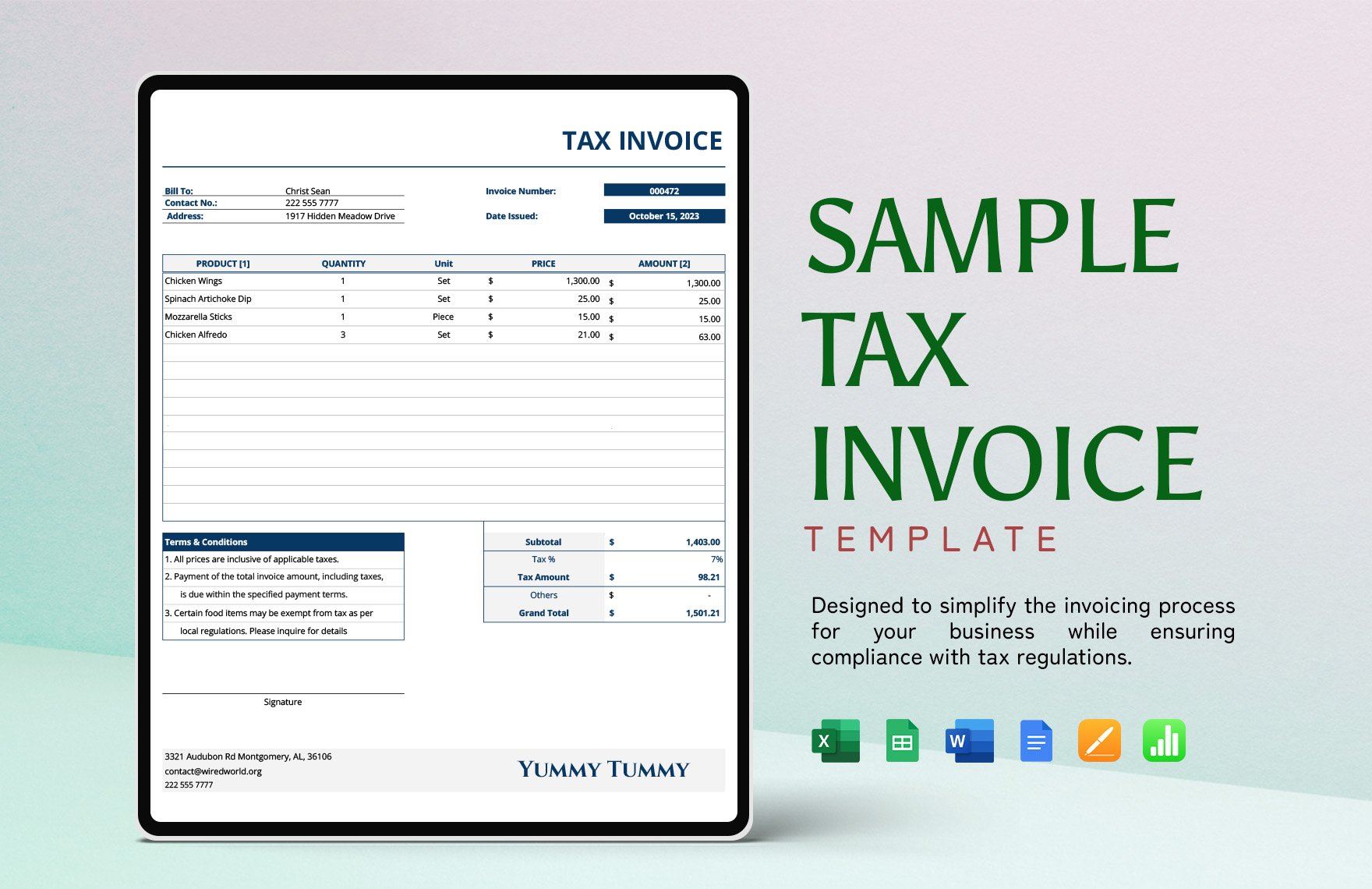

Sample Tax Invoice Template

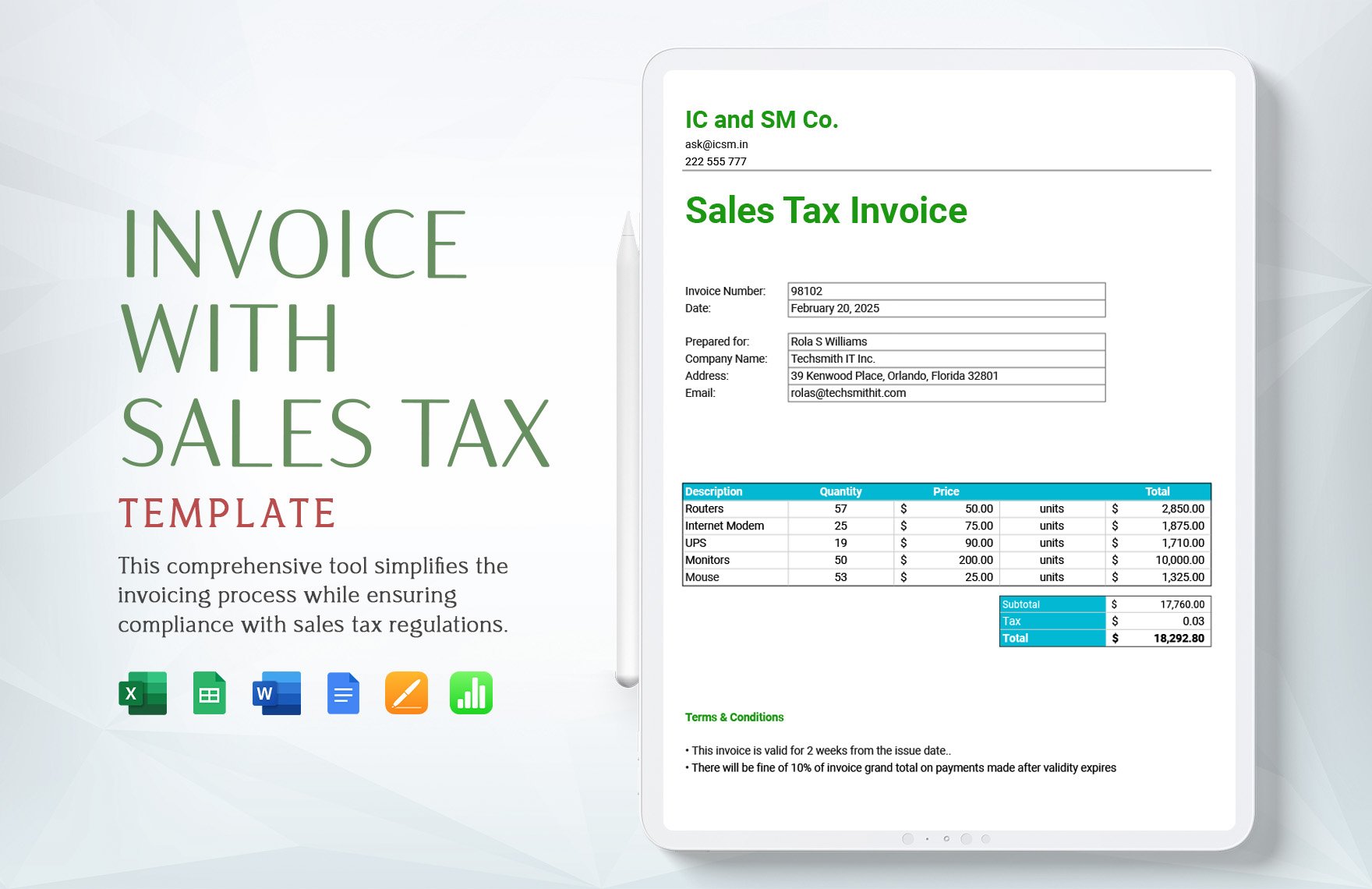

Invoice with Sales Tax Template

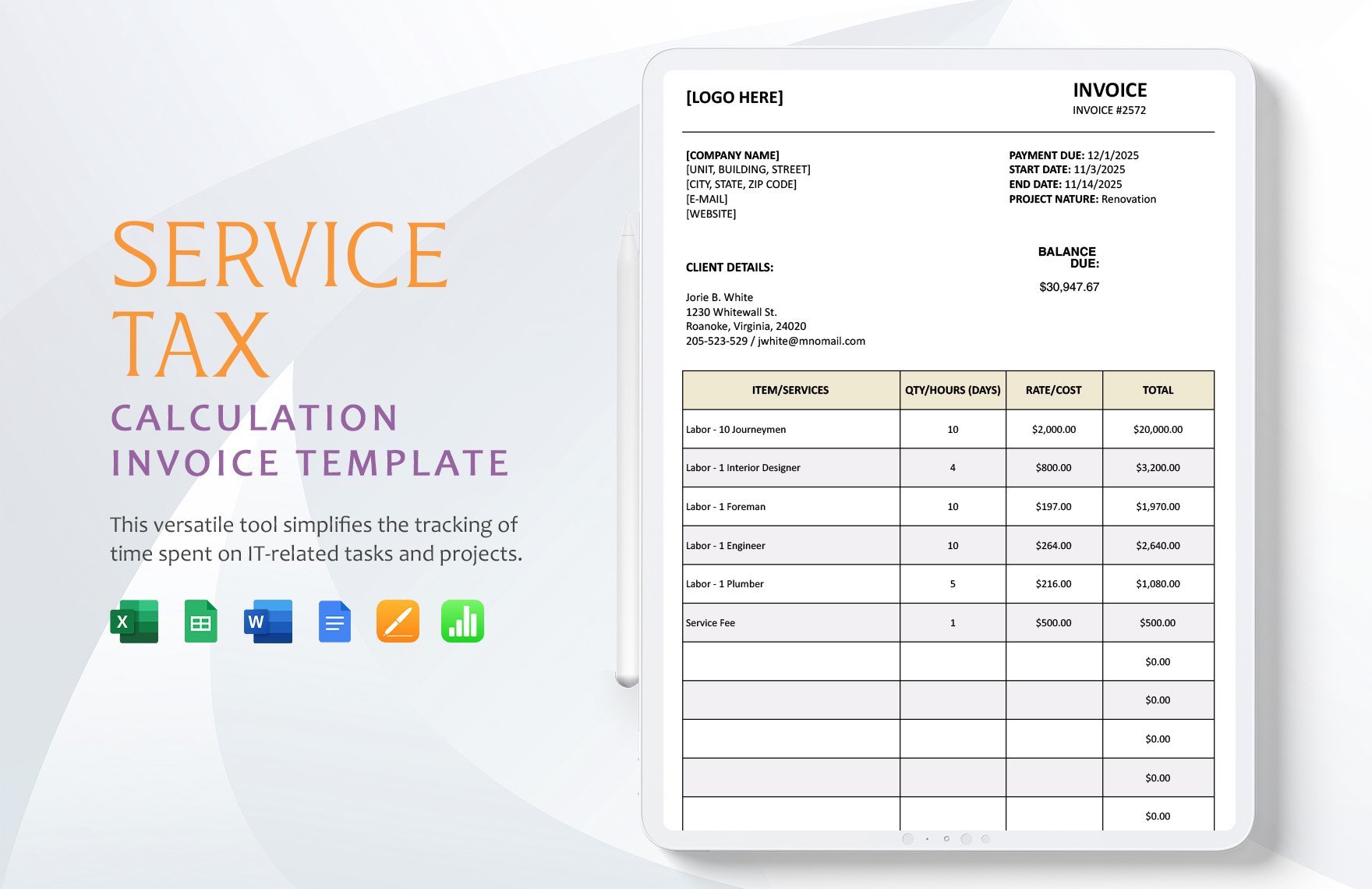

Service Tax Calculation Invoice Template

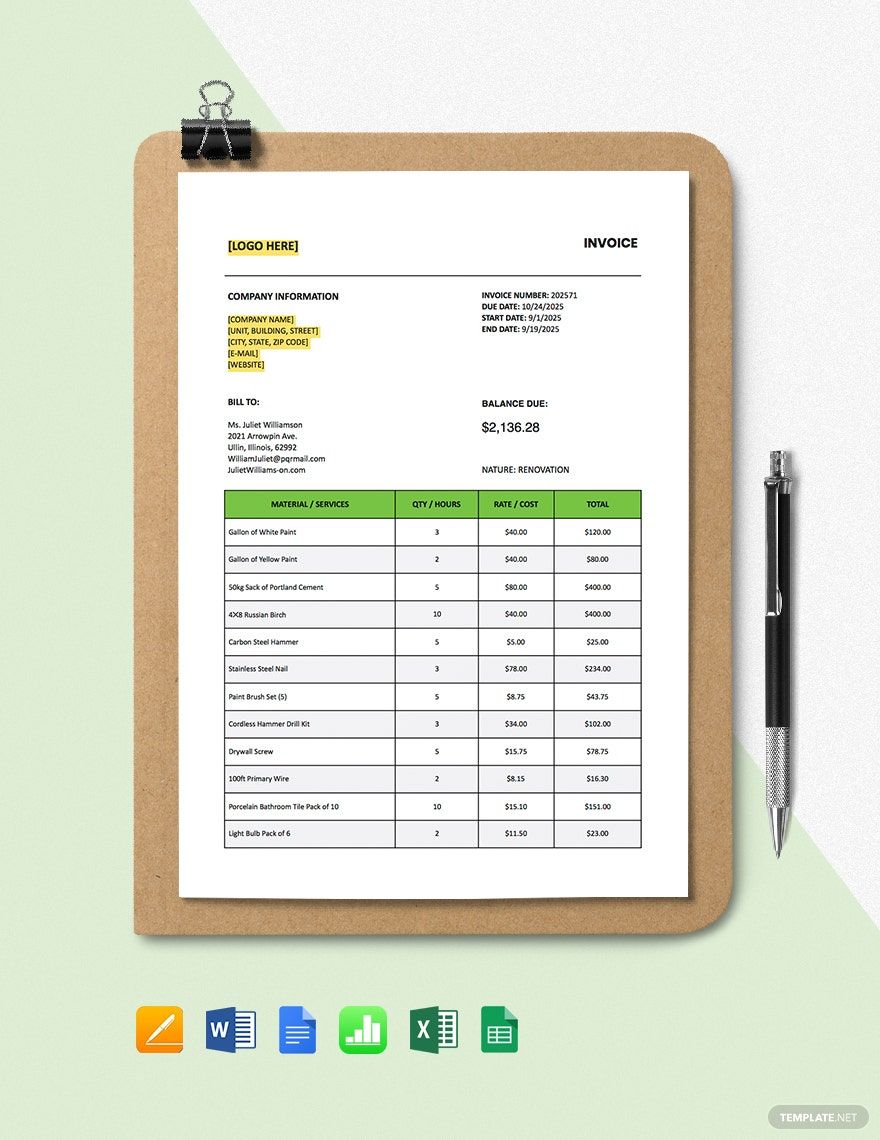

General Tax Calculation Invoice Template

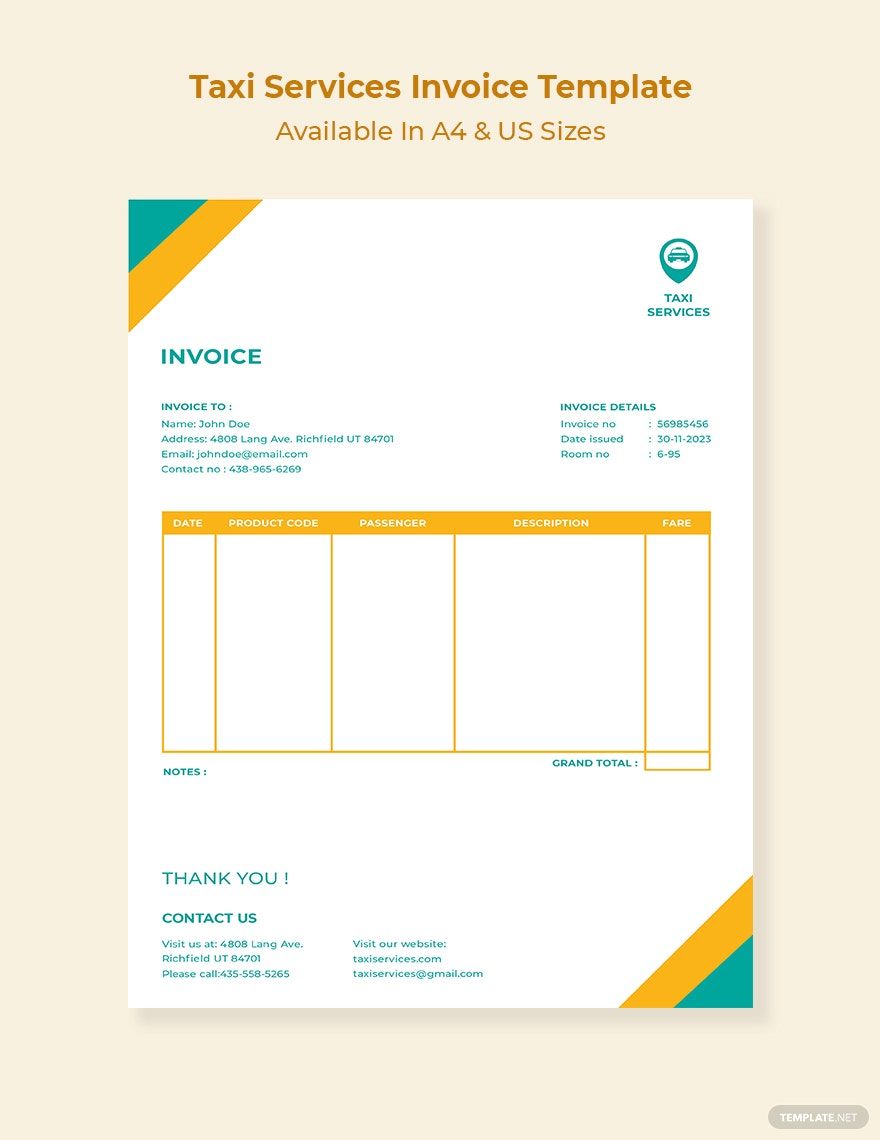

Taxi Services Invoice Template

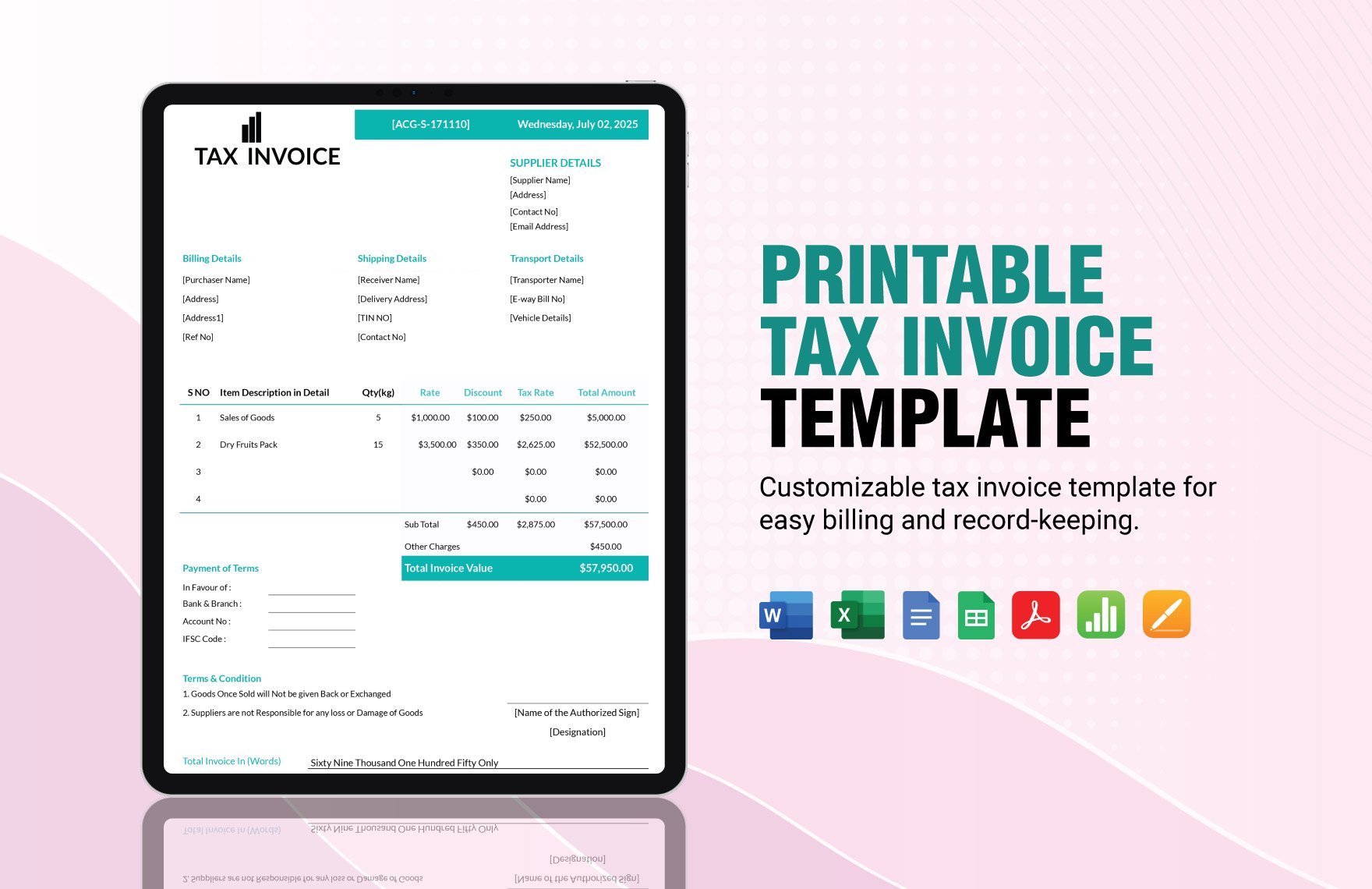

Printable Tax Invoice Template

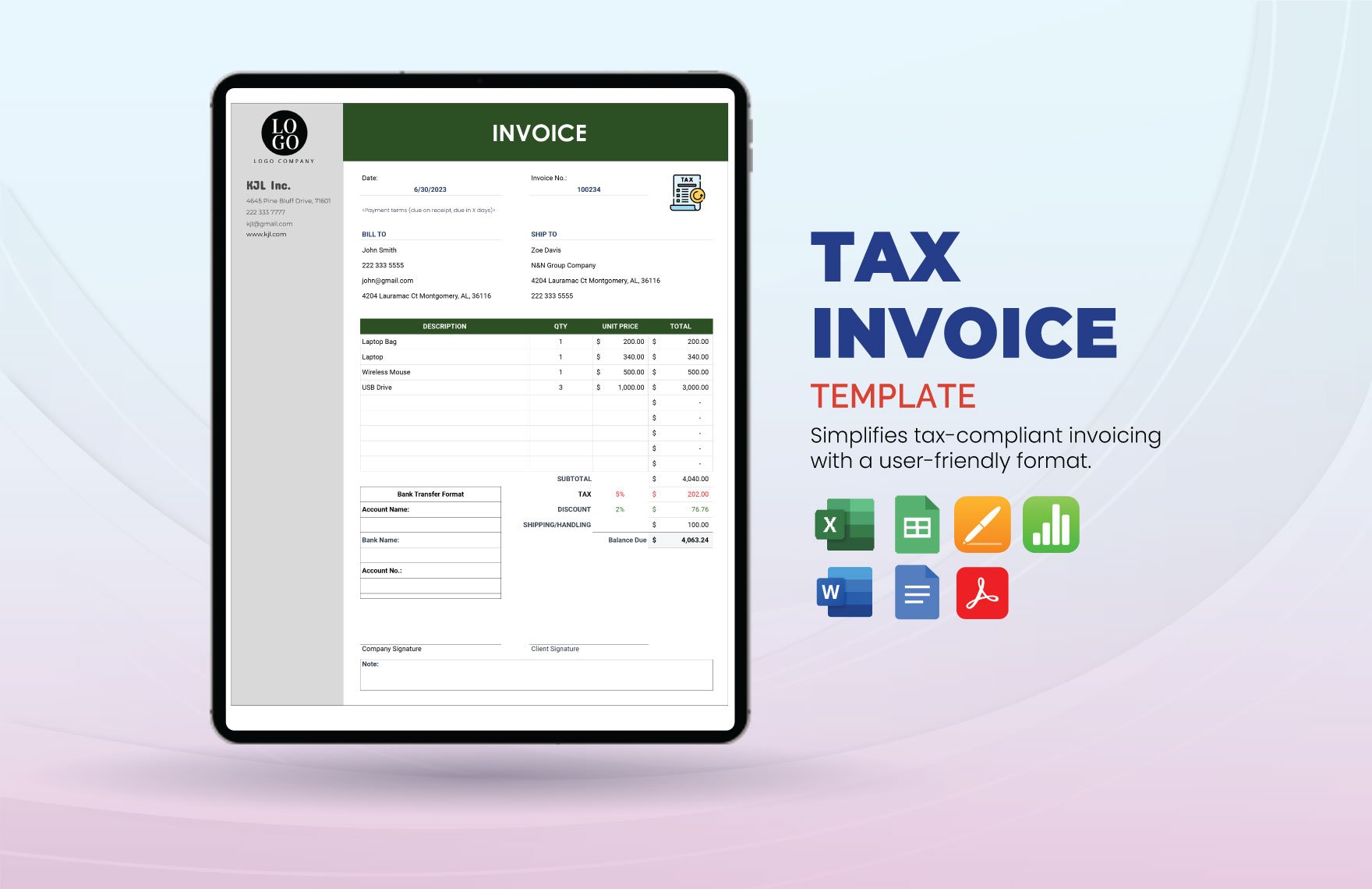

Tax Invoice Template

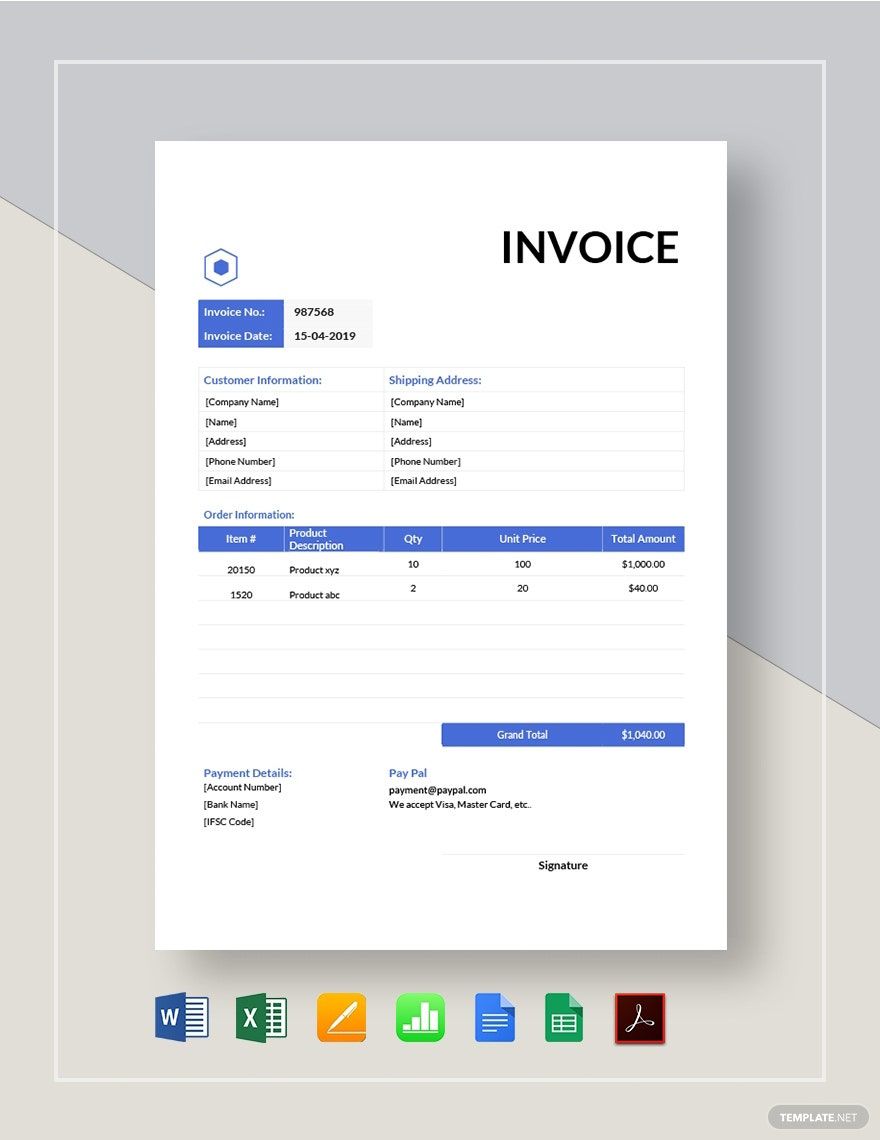

Non Tax Invoice Template

Simple Tax Invoice Template

According to Tax Foundation, last 2016, around 140.9 million were paying taxes in the United States. As everyone knows, it's every business' responsibility to pay tax to the government. Additionally, your clients must also pay taxes. And to professionally tell them their payment, you need a tax invoice. This invoice will show all the information a client has to know for the tax payable. For that, check out our stock of ready-made Tax Invoice Templates in Microsoft Excel (XLS). This template has a formal and professional layout for any business. It's 100% editable, too. Download a template now!

To request a client to pay for taxes, you have to send him or her a tax invoice. This document contains all the necessary information that your client needs to know about his or her payment. And to start making an simple invoice in MS Excel, check out the tips below.

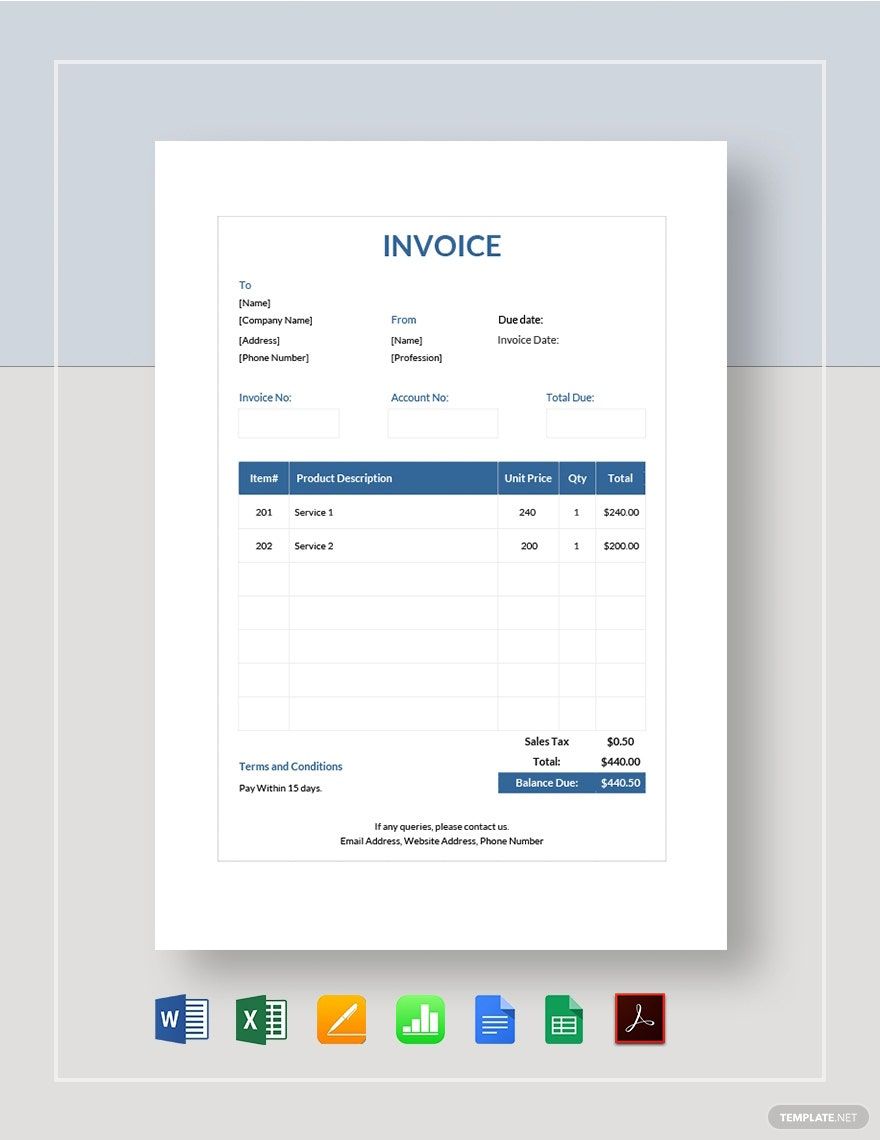

For the client to know who the sales tax invoice is from, you must add your company's details. The details include your company's address, name, logo, contact details, etc. This information will give the invoice document an identity.

Aside from your company's details, you should also add the client's information. By doing this, you'll know who and where to send the invoice. You can also use the clients' details to track who among the client has paid or not.

Thirdly, your business invoice needs invoice number, tax identification number, and invoice date to be official. These details must be present on every tax invoice that you issue to each client.

Like any other basic invoice types, tax invoices must have details of the services or goods you've completed. Be specific in this section so the client won't have lots of questions. In this category, you need to write the services or products' names, hourly rate (services), prices, the total amount, etc.

Since you're requesting for tax payment, ensure that you carefully calculate the numbers. You have to add the charged tax for each item (e.g., VAT), so the client will know about it. Lastly, highlight the amount the client has to pay with the inclusion of the taxes.

To complete your sample invoice, you need to add the payment details. Write when the invoice is due, how the client can pay, and other essential payment information that you think is essential to the transaction.

An invoice format pertains to the arrangement of the content of an invoice.

An invoice and bill are documents that clients or customers receive from a seller or a service provider to request payment. Both bills and invoices may have the same function, but they have a slight difference. You use the term bill for paying ahead or immediately while you may use the word invoice for requesting payment later.

Invoices have different types, and you can use a particular type of invoice based on your needs. We've prepared a list of some of the types of invoices you can use for your business below.

A lot of people may find invoices and receipts are the same, but they're not. Firstly, you use the invoice to ask for payment from your clients or customers after completing your services. Oppositely, you send a receipt to your clients after they pay for your services.

The document that comes first is the purchase order. A purchase order is a document that clients prepare for the seller to request products or services. After delivering the services or products, the company will send invoices to their clients for payment purposes.