Profit loss statement template sole proprietorship

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on the page. However, this does not influence our evaluations. Our opinions are our own.

A profit and loss statement—also called an income statement or P&L statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. It’s usually assessed quarterly and at the end of a business’s accounting year.

While business accounting software makes it simple to produce a P&L statement, we recommend that you familiarize yourself with the terminology and process. This guide will teach you how to analyze and prepare a profit and loss statement—plus, download our free profit and loss statement template to use for your business.

In this guide:

What’s Included in a Profit and Loss Statement?

Before you can create and analyze your own profit and loss statement, it’s important to understand what’s included in this report and how it works.

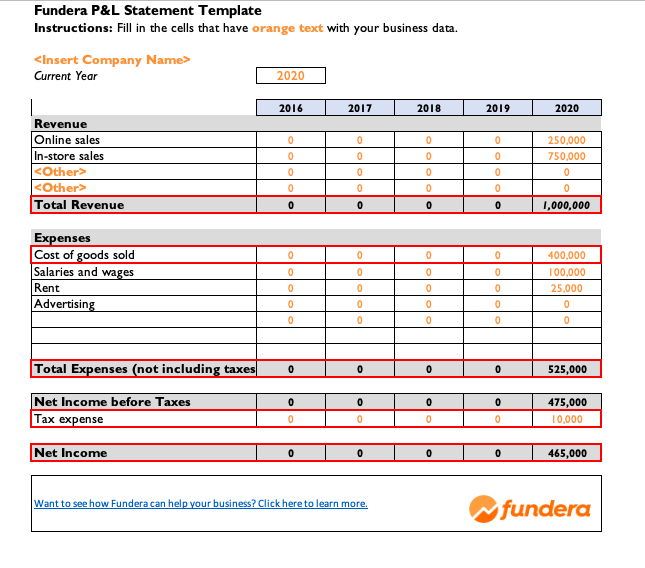

Overall, a profit and loss statement can be broken into five parts (highlighted in red in the image below):

- Revenue (or income)

- Costs of goods sold (COGS)

- General expenses

- Other expenses—including taxes, interest, etc.

- Net income

With this overview in mind, let’s walk through the most common terms included in a profit and loss statement—and their definitions:

- Revenue: Revenue includes the total sales that you make, but it also includes money you receive from things like selling property and equipment or receiving a refund on your taxes.

- Expenditures: It’s not difficult to figure out what information is contained in the total expenditure line, but there may be specific types of expenditures you may not be familiar with.

- Cost of goods sold (COGS): Even though you might sell a cup of coffee for $3, you don’t actually make $3 from the sale. You have to account for the cost of the materials and the time it takes to produce it, which is the cost of goods sold (COGS).

- Gross profit: This is the number you get when you subtract the cost of goods sold from your revenue.

- Operating expenses (OPEX): Operating expenses include any costs associated with running your business that are not included in the cost of goods sold. P&L statements usually divide these expenses into descriptive categories like payroll, travel, training, building leases, utilities, equipment purchase, hardware and software, advertising, cell phone, and internet service. The list can get quite extensive, depending on the size and type of small business you operate.

- Depreciation: You probably already know that if you drive a new car off the lot, it immediately loses some of its value. This is depreciation, and it doesn’t just apply to cars. Equipment, machinery, and other business goods lose value over time as well, and this can be counted as a loss at tax time.

- EBIT: This acronym stands for earnings before interest and tax. It’s calculated by subtracting operating expenses from gross profit. Another term for EBIT is operating profit.

- EBT: This stands for earnings before tax, and this number comes from subtracting both COGS, OPEX, interest, and depreciation/amortization from your total revenue. EBT is a great indicator of business performance and makes it easier to compare your business to others if you need to.

- Earnings available for common shareholders: If your company has investors or if you take a salary from the company, this line is important because it shows a net after-tax profit, minus any dividends for preferred shareholders.

- Owner’s draw: This is any salary for the business owner which comes out of company revenues.

- Net Income: Net income, or profit, is the proverbial “bottom line” on a profit and loss statement for small businesses. It’s what’s left after you subtract all your expenses from your total revenue. Hopefully, you’ll see a profit, but there is a chance you’ll show a loss, especially if you’re just starting out in business. This is obviously the most important line on the income statement.

Download Our Free P&L Template

How to Read a P&L Statement

If your profit and loss statement seems intimidating, don’t worry. It’s easier to understand if you break it down into three overarching categories:

- Revenue: Sales/revenue/income—all the money your business has made is normally listed first

- Expenses: Costs/expenses—how much it costs your business to make money is listed next

- Net income: Your bottom line at the conclusion of the statement

These categories are then broken down into sub-categories. For example, revenue could include your various revenue sources (e.g. in-store sales and online sales). Similarly, you can break down your expenses into sub-categories, like the cost of delivering your product or service (COGS), and the general operating costs of the business (OPEX).

On your P&L statement, you’ll also find your gross profit or gross margin (calculated by revenue minus COGS). This number indicates how much capital is left over for other expenses. Next, your operating profit (EBIT) is the result of gross margin minus operating expenses. Finally, after accounting for interest, depreciation, amortization, and taxes, you’ll get your bottom line—also known as net profit, net income, or net earnings.

Your bottom line reflects your business’s profit or loss. If you show a loss, you spent more than you earned. If you show a profit, you made more than you spent. Your bottom line signals whether you need to increase revenues, cut costs, or both. Over time, your profit and loss statement can also show your business’s growth, as well as patterns in income and expenses.

All of this being said, you should also generate a balance sheet and a cash flow statement for your business. These three financial statements combined offer a more comprehensive overview of your business’s financial health.

P&L Statement Example

To help you better understand this financial statement, we’ve created this profit and loss statement example that shows you all of the terms we’ve covered so far: